Access to capital is a common challenge for Black-owned businesses in Illinois, but there are many resources available to help. Whether you’re just starting out or looking to grow, understanding your funding options is key. Illinois offers a variety of grants, loans, and community programs designed to empower Black entrepreneurs and support business success.

1. Grants: Free Funding for Growth

Grants are an excellent way to secure funding without the need to repay. Many programs offer grants specifically for Black-owned businesses. These funds can be used for startup costs, expansion, or day-to-day operations. When applying, be sure to highlight your business’s unique mission and impact.

2. Loans and Credit Options

Loans provide another important source of capital. There are options available with low interest rates and flexible terms, often designed to support small and underserved businesses. Some programs focus on business performance rather than credit scores, making it easier for new entrepreneurs to qualify.

3. Government and Community Resources

Several organizations and agencies offer support for Black-owned businesses. These resources may include grant and loan programs, business training, and networking opportunities. Connecting with these groups can help you access funding and gain valuable business skills.

4. Leveraging Business Directories

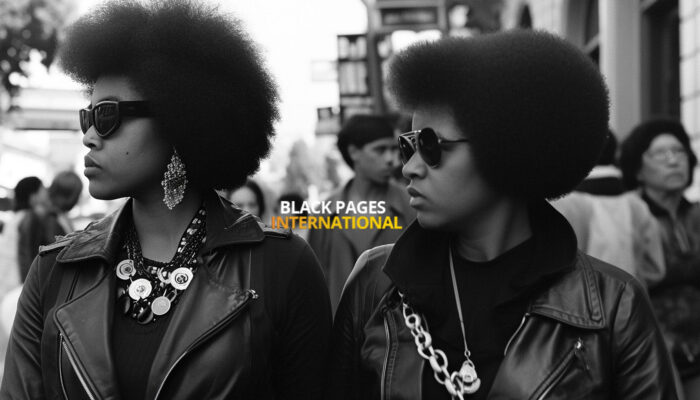

Listing your business in reputable directories can boost your visibility and help you connect with potential customers and investors. Black Pages International is a premier directory for Black-owned businesses in Chicago and beyond, offering a platform to increase visibility, attract new customers, and connect with potential investors. By listing your business, you gain access to a supportive community and a wealth of resources, including up-to-date information on grant deadlines, funding workshops, and networking opportunities.

5. Tips for Securing Funding

- Prepare Your Documents: Gather financial statements, tax returns, and a clear business plan before applying.

- Highlight Your Story: Emphasize your business’s mission and the positive impact you aim to make.

- Network and Seek Guidance: Connect with mentors and other business owners for advice and support.